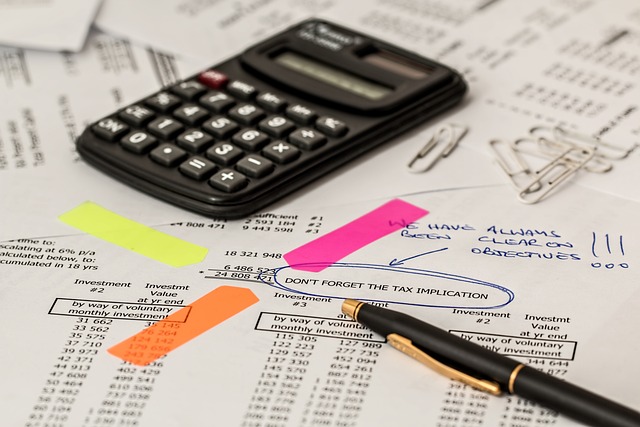

本日の日経新聞によると、米財務省が大企業の財務会計上の利益に15%の最低法人税率を課す枠組みを公表したようです。収益性の高い100社程度の企業が対象で、近年問題になっている(多国籍)企業の行き過ぎた租税回避に網をかける狙いがあります。

【English】

The U.S. Department of the Treasury has announced a new tax policy to impose a minimum 15% corporate tax on the accounting profits of major corporations. Approximately 100 companies, including leading IT giants, are expected to be affected by this policy. The policy targets large firms that report significant accounting profits but pay minimal or no taxes due to aggressive tax saving strategies.

The objective of the policy is to enhance taxation on such companies, ensuring they contribute their fair share of taxes. This is part of a broader effort to prevent the erosion of the tax base, which has been a growing concern in recent years due to aggressive tax avoidance practices.

By addressing this issue, the government aims to create a more equitable tax system, reduce loopholes, and ensure that highly profitable corporations are paying an appropriate level of tax, reflecting their profit margins.

コメント