Hi, Guys. I hope you’re doing well.

Today, I’d like to discuss the Income Statement, also known as the Profit and Loss Statement (P/L).

✅ Income Statement

A firm’s Income Statement provides its financial performance over a period of time.

An Income Statement, also known as a Profit and Loss Statement, is a financial statement that summarizes a firm’s revenues, expenses, and profits (or losses) over a specific period of time, typically a fiscal year.

On the contrary, the Balance Sheet shows financial position at a single point in time.

By using an analogy, the balance sheet is like a snapshot, while the income statement is like a video.

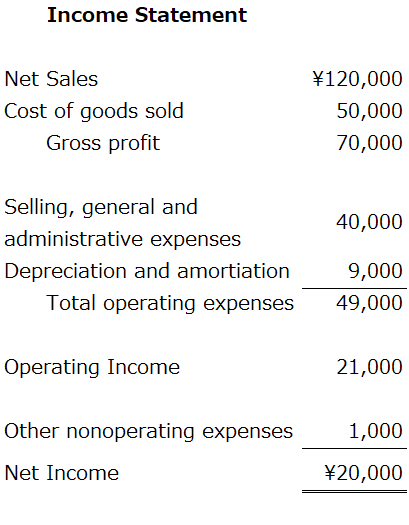

The following is a sample income statement.

✅ Revenue, Cost of Goods Sold and Gross Margin

The first section shows the firm’s revenues or sales, while the following section shows the firm’s expenses.

Revenues(or sales) are the gross increases in stockholder’s equity of the firm that result from operating the business.

Gross Profit refers to the sum of a firm’s revenues, minus Cost of Goods Sold(CoGS).

Conventionally, in the income statement, profits are presented in multiple stages.

The Income Statement separates Operating Expenses from Non-Operating Expenses.

Operating Expenses are the expenses related to the normal operation of the business and sometimes divided into “Selling, general and administrative expenses”(SGA) and depreciation and amortization.

SGA includes rent, insurance premiums, and employees’ salaries.

Non-Operating Expenses are those that are unrelated to the regular operation of the business.

We separate Operating Expenses from Non-Operating Expenses because it helps us calculate Operating Income.

Operating Income provides a more reliable forecast of the firm’s future income.

コメント