This time, let’s talk about Balance Sheet or Statmenet of Financial Position.

The term of Statement of Financial Position is used in International Financial Reporting Standards (IFRS) and chances are this term is not familiar to you.

So I’ll use more widely known term as Balance Sheet.

The Balance Sheet shows a company’s financial situation at a given point in time.

There’re three sections of the Balance Sheet: Assets, Liabilities, and Shaleholders’ Equity.

Remember what we were talking about last time : Accounting Equation.

【Accounting Equation】

Assets = Liablities + Shareholders’ Equity

All three sections or terms apper on the Balance Sheet.

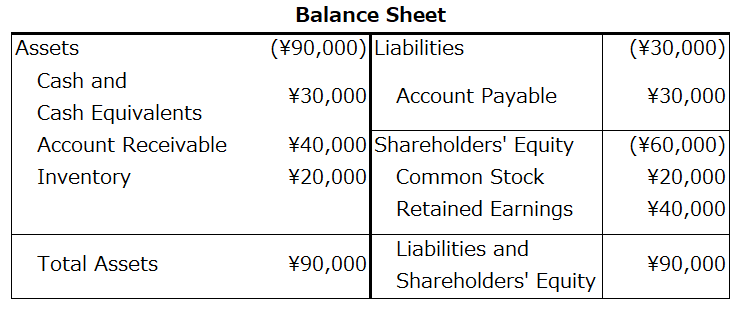

Here’s a simplified Balance Sheet.

According to the Balance Sheet, total assets equal liabilities and shareholders’ equity, totaling 90,000 yen. In other words, the accounting equation holds.

So, let’s look over what each of the accounts refers to.

✅ Assets

Cash and Cash Equivalents refer to assets that are readily convertible into cash.

Cash includes physical currency(coins and bills), as well as balances in bank accounts and so on.

Cash Equivalents are highly liquid investments that are easily convertible into known amounts of cash and have minimal risk of changes in value.

Examples of Cash Equivalents include treasury bills(T-bills), money market funds(MMFs), and short-term certificates of deposit (CDs).

Accounts Receivable is amounts due from customers for goods or services that have already been delivered.

Inventory refers to goods or materials kept in stock, available for sale.

✅ Liabilities

Accounts Payable refers to amounts due to suppliers for goods or services that have already been received.

✅ Shareholders’ Equity

Common stock refers to shares of ownership in a company.

Retained Earnings refers to the cumulative profits of a company that have been retained over time rather than being distributed to shareholders.

I haven’t been dealing with several essential terms or concepts so far.

But no need to wory. Some of them will be discussed in the near future.

That’s all for today.

Cheers.

コメント